Limited recourse borrowing arrangement allows you to leverage your SMSF to invest in real property directly.

The law allows for borrowing to fund the purchase of a real property by a SMSF through a properly structured arrangement. Investments can be made in both residential and commercial property. The correct structure will need to be in place prior to entering any agreement to purchase the property.

Benefits of leveraging

Investments can be made in both residential and commercial property.

A SMSF can purchase a residential property. There are certain restrictions on acquiring property from a person or entity related to a trustee or member of the SMSF. There are also restrictions on the leasing the property to a person or entity related to a trustee or member of the SMSF. A SMSF cannot purchase a residential property from a member of the SMSF or a related party, and cannot lease the residential property to a member of the SMSF or a related party.

A SMSF may purchase a property off the plan.

Commercial property can be purchased at market value from a member of the SMSF or related party and can be leased to a business related to a member on commercial terms, including the amount and frequency of rent payment.

This may be an attractive option for business owners:

| A SMSF cannot purchase a residential property from a member of the fund or a related party, and cannot lease the residential property to a member of the fund or a related party. | |

| Business property can be purchased at market value from a member of the fund or related party and can be leased to a business related to a member or related party. A business property is a real property that is used wholly and exclusively by one or more businesses. | |

| A SMSF cannot purchase land and construct a house on that block using borrowings, or purchase a house and land package using borrowings unless that house and land package is sold on a single contract with settlement of the whole property after completion of the construction. | |

| 'Off the plan' apartment can be purchased as long as the deposit and any other amount required to secure the purchase is not borrowed, and once the apartment is completed and strata titled, borrowings can be used to complete the purchase. |

To be able to borrow to fund an investment, the borrowing must satisfy certain conditions. The law allows for borrowing to fund the purchase of a real property by a SMSF through a properly structured arrangement:

A property meets the single asset definition if the property being acquired is on a single title, or the property being acquired is on more than one title and it is reasonable to conclude it is distinctly identifiable as a single asset. For example:

Where the vendor will only sell more than one title together, and there is no physical or legal impediment to dealt with the titles seperately, it will not be a single asset.

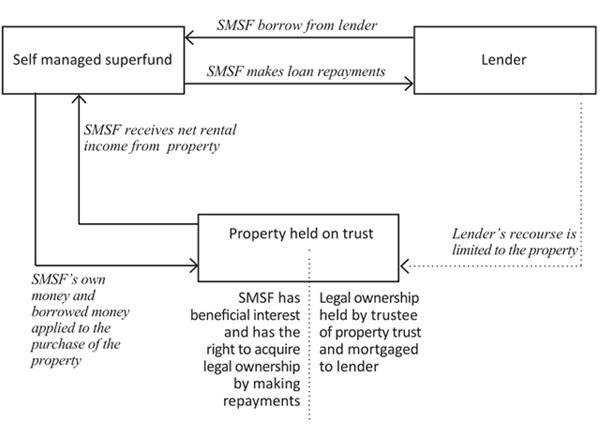

The structure requires the real property to be acquired and held in a seperate trust for the SMSF. The legal ownership of the property is held by the trustee of the seperate trust with the SMSF having the beneficial interest.

The SMSF borrows money from a lender. In return, mortgage over the property is provided to the lender as security for the borrowing. The right of the lender is limited to the real property only on loan default.

All income (e.g. rent income) are received by the SMSF directly, and expenses (e.g. expenses associated with holding and maintaining the real property), principal and interest loan repayment are paid by the SMSF directly.

The trustee of the seperate trust is normally a new company established for this purpose. The seperate trust is normally a bare trust that only holds that single property, and its role is limited to holding the title of the property. As the income derived from the property are received by the SMSF directly, and the loan repayments are paid by the SMSF to the lender directly, the seperate trust should not register for an ABN or tax file number, and does not lodge a tax return. They are instead contained within the SMSF's Annual return.

The borrowing structure should be set up prior to entering any agreement to purchase a property. This is important, as the legal owner of the property is the trustee of the bare trust, and not the trustee of the SMSF.

If you have any questions, or wish to set up the structure to borrow to invest in property in your SMSF, please contact us. Where you current SMSF trust deed do not provide the requisite power to borrow or prohibits borrowing, we can update your SMSF trust deed to allow for the SMSF to borrow.

Setting up the LRBA structure |

Generally, the SMSF borrows to acquire an asset pursuant to a limited recourse borrowing arrangement from a bank or finance company. If the SMSF is borrowing from a related party (a member or related party), the loan must be on arm's-length basis.

The question that needs to be asked is "Can the SMSF get the same deal in the open market?"

The proposed terms of a related party limited recourse loan must be compared against a loan that a lender (bank or finance company) would make to the SMSF in the same circumstances.

It is strongly recommended that the trustees obtain a written statement of loan terms from the bank or finance company - even if there is no intention of borrowing from the bank or finance company - and retain as evidence that the related party loan was on arm's length terms that replicate the terms the bank or finance company was offering the SMSF.

Alternative, the trustees may rely on Australian Taxation Office safe harbour terms instead of testing the market for a loan.

ATO Practical Compliance Guidelines PCG 2016/5 sets out guidelines of the terms on which SMSF trustees may structure their LRBA with related party loan that are acceptable to the ATO. The structuring of the related party loan in accordance with the guidelines will mean that the ATO will accept that the non-arms length income provisions do not apply. More details from our guidance.

Do you need help with your situation or if you wish to discuss the above, please contact us. Our contact details.