Specialist SMSF Firm, Chartered Accountants, SMSF Tax AdvisersAbout us

You deserve an experienced SMSF specialist. You can rely on us for sound and practical advice. We will look after all your SMSF’s accounting, taxation and compliance needs.

We are an independent provider of SMSF compliance and advisory services. Our paramount aim is to provide quality and flexible services to our clients.

We are trusted by trustees and professional advisers as their SMSF specialist. We are always available to help.

Becoming a Superannuation Accounting Services client ensures that you and your SMSF are well looked after.

Our servicesSwitching accountants doesn't have to be difficult or costly. It can actually be beneficial. We manage the whole process and make it simple for you, and there is no cost involved in switching to us.

Often, you will end up saving money on fees and benefit from superior services from a SMSF specialist - technical experts providing you with complete solutions to your questions and full service accounting and compliance reporting where you can access timely financial information.

Our fees are transparent, and we offer you a fixed fee. No surprises.

Change provider

The Treasurer delivered the Federal Budget on Tuesday 9 May 2023. A temporary surplus of $4.2 billion forecasted for 2022-23 and thereafter expected to be back to deficit. Inflation has peaked and is expected to moderate. Some expensing measures includes cost-of-living relief and strengthening Medicare.

More details

The law allows for borrowing to fund the purchase of a real property by a SMSF through a properly structured arrangement. Investments can be made in both residential and commercial property. The correct structure will need to be in place prior to entering any agreement to purchase the property.

More details

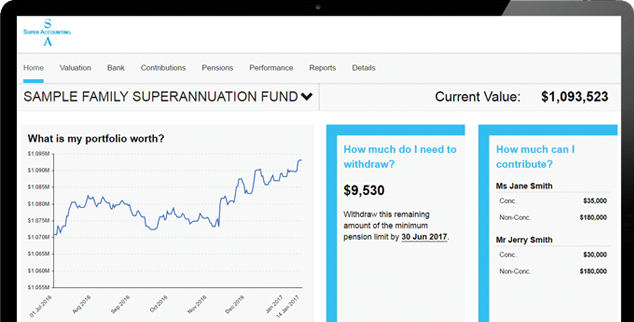

Access to your SMSF financial information 24/7 online. You invest, we report. Don’t wait for annual or quarterly report. Get secure online access to timely financial information for your SMSF.

We can receive data directly from your banks and investment providers, relieving you from this administrative task. Easier and less paperwork for year-end tax compliance and audit.